For years, I’ve been recommending that you move your accounts – chequing and savings – out of the Big 6 banks in Canada.

Who are the Big 6?

They’re the largest brick-and-mortar financial institutions in Canada:

- TD

- RBC

- CIBC

- Scotiabank

- BMO

- National Bank

Why shouldn’t you use them?

It boils down to two main factors: Fees and lousy interest rates.

If a bank is going to charge you fees, there had better be a good reason for it in this day of free online services.

Some argue that the “small” monthly fees they charge don’t amount to much for the convenience and the belief that big banks are safer.

That’s fine, if you like burning money. 🔥

But I’m not a fan of that.

I’m pretty sure you can think of a lot of good, productive, or fun things to do with $150 rather than give it to a bank for no reason.

They don’t provide any advantages for the fees they’re charging.

And the interest rates offered by the Big 6? 🤣

Hang tight. We’ll get to those in a second.

If you want a quick overview of the main arguments to avoid brick-and-mortar banks, start here: Is It Worth Paying For a Chequing Account? Banks vs Free Alternatives.

Today, I want to dive into the fact that EQ Bank has just given you one more reason to ditch the Big 6.

They might just have given themselves the edge over other online financial institutions, too, with their latest addition: The EQ Bank Card.

The EQ Bank Card

One of the complaints about EQ Bank in the past is that they didn’t have a bank card, which means no ready access to cash through their accounts and no ability to make online purchases.

They’ve been working hard at becoming your one-stop-banking choice, which is why they added all sorts of functionality on the chequing side of the equation in their Savings Plus Account – a hybrid savings and chequing account.

Their recent announcement of the addition of the EQ Bank Card closes that gap.

What caught my attention with this card are some cool features that make it quite attractive.

Here’s a quick overview of what the card is and does:

✨ It’s essentially a debit card on steroids.

It works like a prepaid credit card in that you load it with funds from your account.

Unlike prepaid credit cards, though, this card has zero fees.

✨ You can use the card to pay for purchases anywhere that Mastercard is accepted.

Equitable Bank has joined forces with Mastercard International Incorporated under a licensing agreement, which means that you can use this card as you would a Mastercard to make online purchases.

Remember that it’s a debit card at its root, though, so you can only make purchases if you already have the money and it’s loaded on the card.

The plus side of this is that you can’t go into debt with this card.

✨ You earn 2.5% (at the time of writing) on the money loaded on the card before you spend it.

That’s the same interest rate for their high interest savings account – the Savings Plus Account.

This is a cool feature! The card is essentially an extension of the savings account.

✨ There are no foreign exchange fees.

With a typical credit card, when you make purchases in other countries, not only do you pay a currency conversion fee to get the purchase back into Canadian dollars, you also pay a foreign exchange fee. That fee is typically 2.5%.

Not with the EQ Bank Card. You make the purchase, you pay the currency conversion cost on the day you purchase it, but there is no foreign exchange fee.

✨ You can use this card at any ATM without paying fees.

No more hunting for the nearest branch that’s tied to your bank. You simply use whichever ATM is closest to you when you need cash.

✨ You get 0.5% cash back on your purchases.

Nobody is going to get rich off half a percent, but it beats out most of the other cards in its class by offering cash back (except Wealthsimple; we’ll talk about them in a minute). Consider it to be a 0.5% discount on everything you buy.

This changes things

In 2021, I wrote this article on why I recommended Tangerine for your chequing account and EQ Bank for your Savings Account.

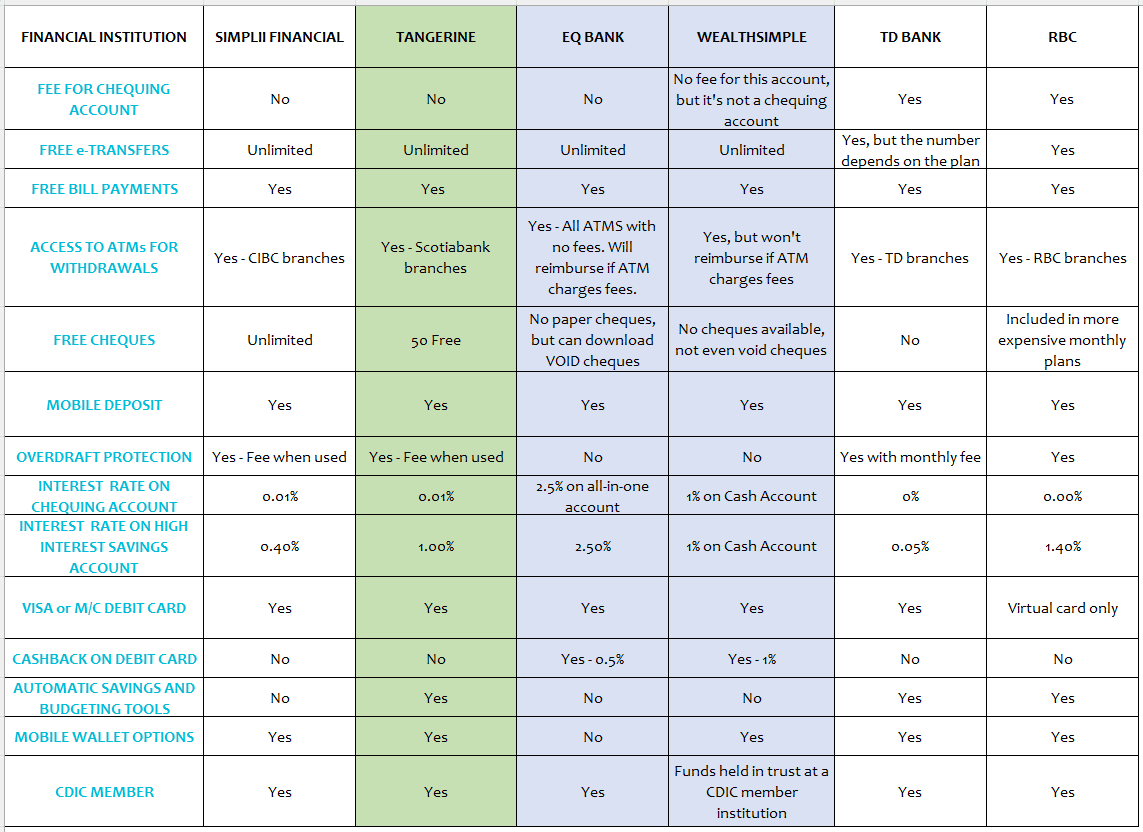

In my post, I presented a comparison of a number of online offerings.

I’ve updated that spreadsheet and added the two biggest banks in Canada for this article.

Here’s how their respective offerings stack up now:

I’m not going to mention the Big 6 banks beyond this point because a) they charge for their chequing accounts, which is unacceptable in today’s world; and b) their interest rates are ridiculously low.

So they’re out of the picture.

To be fair regarding the interest rates, Simplii and Tangerine also have very low interest rates for their savings accounts. I would not recommend that you use them for your savings dollars for that reason.

Cashback

EQ Bank is one of only a couple of institutions that offer cashback on their Mastercard Debit card. A 0.5% discount on everything you buy is a win.

You might be tempted by Wealthsimple’s 1% cash back offer, but their interest rate on the account is only 1%, less than half of what EQ Bank offers. When you combine that with the fact that the Wealthsimple Cash Account has less functionality – they even say in their FAQ sheet that this account can’t yet replace your regular chequing account – the win goes to EQ Bank.

Here’s a caveat about Wealthsimple, though: If you’re willing to set up the direct deposit of your paycheque into the account, the interest rate for the account jumps to 3%.

This Wealthsimple perk is useless for self-employed people who don’t pay themselves via a salary (hello dividends) or who pay themselves on an irregular schedule. Wealthsimple definitely loses marks in my books for failing to offer self-employed peeps a benefit that salaried people get.

High Interest Rate

The other institutions on my list don’t come close to offering the rates that EQ Bank has on offer. The latter have been at, or near the top, of interest rate offerings for years now.

With EQ Bank’s Saving Account Plus account (a hybrid chequing-savings account) and this new card, all of your money earns 2.5% (at the time of writing) all the time.

That’s a definite plus.

Could you get a higher interest rate from other institutions for a High Interest Savings Account?

Sure.

Oaken Bank and Saven Financial are currently offering 3.4% and 3.75% respectively. If you’re simply looking for a straight up savings account, then these two are great options for you.

The downside of EQ Bank

One area where EQ Bank is still lagging is when it comes to integrating with digital wallets.

Currently, you can’t use the EQ Bank Card from your digital wallet.

If you’re used to whipping out your phone or your smart watch to pay for purchases, this will be a nuisance.

There is also no overdraft protection. If that’s important to you, you’d be better off with Tangerine.

Ditto for clever tools that help to crank up your savings.

Tangerine has a number of tools, including one that rounds up your purchases to help you save more money.

I’m a bigger fan of setting up automatic transfers to ensure you hit your savings targets, but the tools that Tangerine offers can be a bonus if you’re just building the savings habit.

All in all, short of the digital wallet issue and the lack of a few tools that help with behavioral nudges, EQ Bank comes out on top.

Who would benefit most from this card?

⭕ People who are working on becoming debt-free.

The fact that you can’t add to your debt with this card while still being able to use it like a credit card for your purchases is ideal.

⭕ Students who don’t yet have a credit card.

The interest paid on dollars on the card plus the cashback are a nice win.

Since this card isn’t a credit card, it won’t help to build your credit, so having a “real” credit card will be beneficial as soon as you can qualify for one.

⭕ People who don’t have a points card.

If you always pay off your credit card bills in full, then a good points card may make more sense than this card.

But if you carry a balance, then no points card that comes with a fee is worth it. Focus on paying off all your credit card debt before you think about points, and use the EQ Bank Card in the meantime.

⭕ People who routinely use their debit card.

If you often pay for purchases with a debit card, why not use a card that will pay you interest and give you cash back? It’s a no-brainer.

The takeaway

Choosing the right bank accounts is an important part of building your financial foundation.

If you want to create a Big, Beautiful Life (yes, that takes capitals in my world) and lead it on your terms, you want to ensure that you have the right tools to support you.

In my upcoming course Your Foundation to Financial Freedom: A proven, step-by-step system to help you take charge of your finances, strengthen your relationship with money, and create great options for yourself, I’ll walk you through a comprehensive audit of your financial tools.

When it comes to chequing and savings accounts, my advice boils down to this:

Don’t use the Big 6 banks.

They offer no value that I can see and in fact, they cost you money.

Consider the online options I’ve discussed above and choose accounts that will serve you well.

Want a proven process to help you make smart financial decisions that are in your highest, best interests every time?

Grab your copy of my FREE Cheat Sheet. In it, you’ll discover the four key questions to ask yourself, in order, to gain total clarity on the right financial path for you.

This process works for all decisions, big and small.

Make indecision, second-guessing, and analysis-paralysis a thing of the past with our Cheat Sheet!