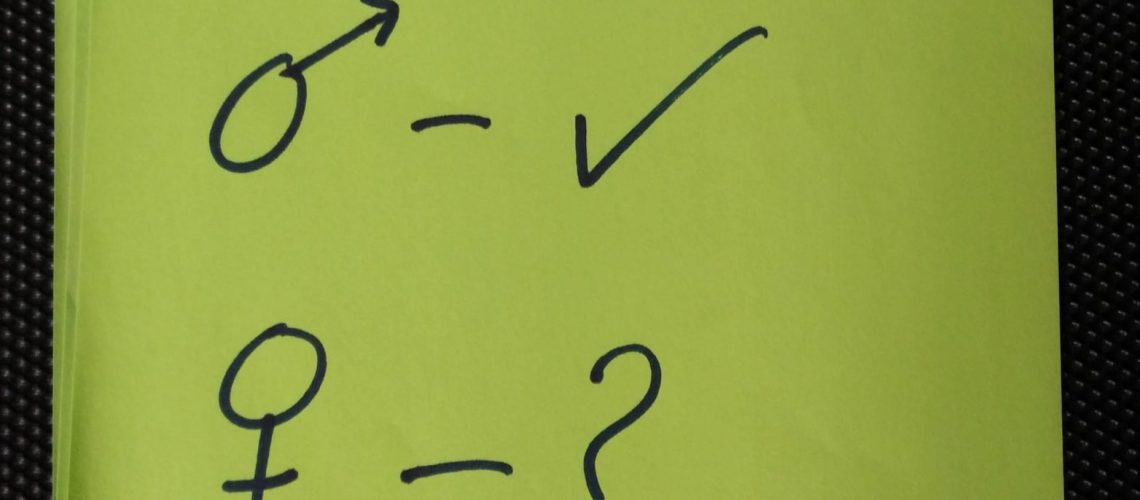

I know, it’s a strange way to phrase a question. Shouldn’t I have asked, “Is it worth buying life insurance for yourself?” That would be grammatical – and miss my point.

Someone I know, who is very familiar with my message of the importance of financial protection for women, recently disclosed to me that while her husband has life insurance, she does not. They have young children, they both work and to boot, she is CEO of Home Central. And I do mean CEO: This lady does everything for that family, including organizing kids’ activities, scheduling, meal planning and preparation, social planning, in addition to the countless jobs that come with being a home-owner.

And yet, she has no life insurance.

We’ve talked about the importance of life insurance for both parents. She’s even read snippets of the manuscript for my book when I was developing the ideas and sharing them with women for feedback. When we spoke about the material, she acknowledged how important it is.

Still, no action.

When I asked her why, she said something about the fact that her husband is the one with the assets; he’s the one with the stuff that has value. I don’t want to give away any details here in order to protect her anonymity, but suffice it to say that there is substantive value on his side of the ledger.

“He’s the one with the assets.”

Let that phrase sink in for a moment. That one, small phrase has had such an impact on me that I have been thinking about it ever since we spoke several weeks ago. How to unpack that. How to tackle what’s behind it.

I could talk about the financial aspects involved in deciding who should have coverage and how to calculate the extent of the coverage, but this issue isn’t really about money. It’s rarely just about money.

This is about self-worth. This is about valuing ourselves, as women, for every ounce of energy, creativity and caring that we pour into our families.

Here’s my message to all women in a relationship where there is an asset gap:

You. Are. WORTH IT.

You are just as valuable as your spouse. You are just as worthy of life insurance. It is equally important that your life be insured. I don’t care if all you brought into the marriage was 25 cents and a broken tea cup, you are the asset.

Want me to prove it? Fine. I’ll kidnap you and take you to Hawaii with me for six months – a girl can dream – without telling him that you’re coming back. Yes, not fun for him, but I’m trying to prove a point here so work with me.

In my hypothetical situation, he has just inherited an emotional, financial, logistical and physical storm. All of a sudden, with you out of the picture, he has to continue his work to bring in his part of the income, make due without yours, become Mr. Mom as well as Dad, and make the juggling act that is your complex life work without you. If he chooses to hire out some bits, it will take time, which he just discovered is in even shorter supply than before now that you’re gone, not to mention the cost of farming out an infinitesimally small fraction of what you do for the household and the family. And if he does hire someone, he still has to manage them. And that, my friends, is a whole other pile of fun, as anyone with a property manager knows.

Still think he’s the only one with the assets?

About those assets

I have lost count of all the women I know who earn less than their mates in part because of the industry that they are in, or because they are the ones who take time off when kids are born. Others work flexible jobs so that they can respond to the inevitable demands on their time when kids are young or when they can’t go to school because they’re ill. When you optimize for one career, it’s not surprising that a wealth, or asset, gap occurs.

I could bring up statistics and literature to show how a wealth gap is created and grows between men’s and women’s earnings, but here’s the bottom line: Women typically have less than men when it comes to traditional wealth. A lot less, for a million and one reasons. So if the only unit of measure is the traditional one when it comes to value, then women don’t look so great.

That said, even if you only took a traditional view of the asset split while considering whether or not to buy life insurance, you would still need to factor in the cost to cover the million-and-one services that the “lower valued” spouse provides and consider the impact on the spouse’s income when he has to suddenly run his life, his work, his kids’ lives and the household as a solo parent. So by these very limited traditional measures, life insurance is vital.

A critical unit of measure

If all we do is take the business-as-usual approach to life insurance, then the question “Is it worth buying life insurance for me?” applies and the answer, in this case, is yes. Hell yes. But I am going to argue that if this is the only question you ask, you are forgetting the most important piece: the bit about self worth.

Money is emotional. We can talk about making rational choices all we like, but that’s an illusion. Behind our money choices lurk our beliefs about ourselves. By failing to insure our lives when we are central to the existence of others’ lives, we send ourselves the message that we are only “worth it” if we measure up by traditional metrics, which in turn sends the very clear message that, in fact, we are not worth quite as much.

Ladies, part of sorting out our complicated relationship with money involves recognizing our true value and making all financial documents congruent with the message we want to send ourselves. Again, it’s not just about the money – though there’s a clear monetary case to be made for the wisdom of life insurance. It’s also about the message to ourselves which will affect how we behave, what we do, and the results we get. We have to value ourselves.

My intent with this post is not to make you feel bad or guilty if you’ve been putting off getting life insurance, but rather, valued. Get life insurance, first, because it makes financial sense for your family as a whole. But, just as importantly, get it because it makes emotional sense. We need to send ourselves a message that what we do, and who we are, matters beyond the financial assets we bring to the table.

You are worth it.