At my book launch for Protect Your Purse, Shared Lessons For Women: Avoid Financial Messes, Stop Emotional Bankruptcies and Take Charge of  Your Money, I gave attendees a financial literacy quiz with the promise of free books for the best and worst mark. Mostly, I wanted my friends and supporters to have fun with it, but I also wanted to raise awareness about key areas of financial fitness, some of which I discuss in my book.

Your Money, I gave attendees a financial literacy quiz with the promise of free books for the best and worst mark. Mostly, I wanted my friends and supporters to have fun with it, but I also wanted to raise awareness about key areas of financial fitness, some of which I discuss in my book.

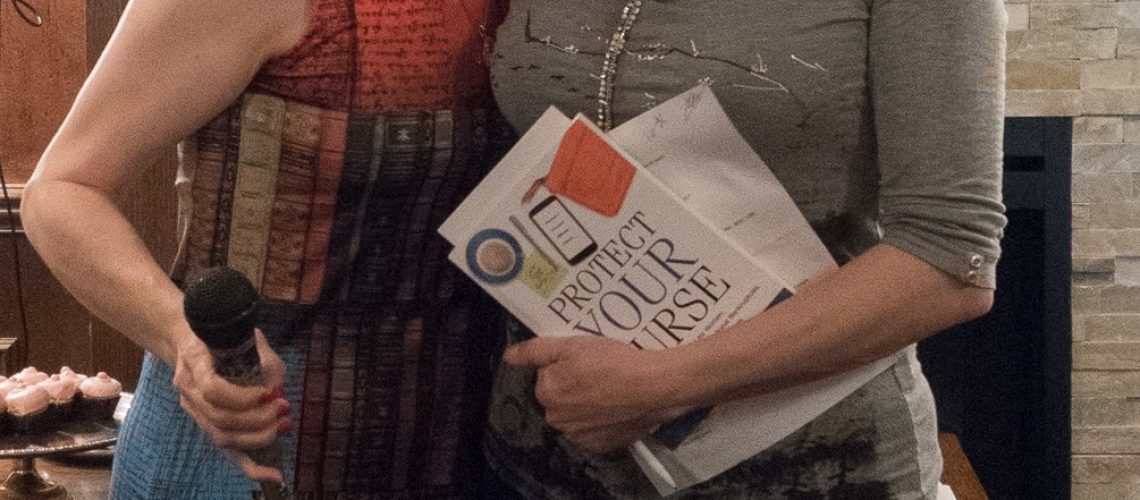

The response to the quiz was terrific. People really got into the spirit of it and had some interesting insights for me once it was done. The winner of the free book for the top mark went to my friend Miglena, pictured here, who said she knew the answers to some of the questions because she reads my blog. (No, I did not pay her to say that.) The winner of the book for the worst mark shall remain nameless to all but those who were in attendance! She was a great sport about it and even insisted to another attendee that her mark was indeed a half point lower. She really wanted the free book!

Several people have reached out since to ask for a copy of the quiz, so I thought I’d post it here so you can take it too. Below the quiz, you’ll find the answers. Let’s see how you do. If you’re brave enough to share your results, please do so in the comments section below the post, or pass along any insights you have. One friend noted that she and her husband got vastly different answers to many of the questions. Time to institute a wine night every month to talk about money and get on the same page!

Have fun with this.

Financial Literacy Quiz

1. According to Stats Canada, what is the average level of household debt?

A. $0.86 of debt for every dollar of income

B. $1.13 of debt for every dollar of income

C. $1.67 of debt for every dollar of income

D. $1.84 of debt for every dollar of income

E. What debt? We’re all in great shape financially.

2. When was the last time you requested/downloaded your credit report?

A. In the last twelve months

B. In the last two years

C. I’m sure I’ve pulled it in the last ten years

D. What’s a credit report?

E. Never. I blame the dog.

3. What is a good credit score according to the Big 6 banks in Canada (e.g. TD, RBC, BMO, CIBC, Scotia, NB)?

A. 480+

B. 580+

C. 680+

D. 980+

E. 11

4. What is the range of possible credit scores in Canada?

A. 100-1,000

B. 100-1200

C. 200-800

D. 300-900

5. If you had your partner/spouse’s computer or phone, would you be able to log-in? (For single people, is there someone who could do this with your phone or computer?)

A. Yes, absolutely

B. I’d have to look up the passwords, but I do have them noted somewhere.

C. No clue how to get in.

D. He/she doesn’t want me to get in.

6. If you were asked to state your net worth, you would:

A. Know the answer within a few thousand dollars

B. Have to ask your spouse

C. Have no clue

D. Take a wild guess

7. Which is the best determinant of financial resilience (i.e. your ability to deal with a major life challenge):

A. Net worth

B. Income

C. Net worth and income are equally important

D. Your personality

8. What percentage of Canadians do not have a signed will?

A. 0%. We’re all rock stars on this front.

B. 40%

C. 60%

D. 90%. We are the worst country ever.

9. We know that the current income gap between women and men is roughly 20%. How big is the wealth gap between men and women (as a percentage)?

____________________________________

10. What impact do late payments have on your credit score?

A. There is no impact.

B. It depends on the amount owed.

C. It depends on how late the payments are.

D. They cause your score to go down.

E. None, because you can call the credit agency and negotiate to have the late payment removed from your record.

11. How often do you sit down to evaluate and/or talk about your finances with your spouse/partner (single people, you get an automatic point on this one):

A. Occasionally, as needed

B. Regularly – several times a year

C. We have better things to do

D. Talk is over-rated

12. Name 3 fees that affect your returns with respect to investments:

1. ______________________________

2. ______________________________

3. ______________________________

ANSWERS:

1. C

2. You get a point for A. I also gave a point for B, but really, you should check your credit report annually to ensure that there are no errors and to keep track of the state of your credit.

3. C. Some A-lenders will accept scores in the mid- or lower-600’s, on a case-by-case basis, but to give yourself the best shot at success, and to ensure the best rates, aim for a score of 700 or greater. To get my free eBook on how to improve your score, check out www.yourfinanciallaunchpad.com/creditscore.

4. D

5. I gave a point for either A or B. The bottom line is that you need to know how to access all files in the event that your partner dies or is incapacitated. If you’re single, you need someone who can do that for you.

6. A. I did not give a point if you have to ask your spouse! Financial literacy is a solo game. It won’t do you much good if your partner/spouse dies and he/she had all the info at his/her fingertips.

7. A. As much as a strong/good/persistent/resilient personality will serve you well, it can’t replace a strong net worth when you’re in desperate need of good options. Similarly, while a strong income is great, it does not necessarily translate to good financial options when life happens. History is full of high earners who blew or mismanaged their fortunes and ended up with nothing. Many lottery winners have nothing to show for it just two to three years later. If you don’t know how to manage and grow money, high earnings won’t get you out of a bind. And the problem with a strong income is that it won’t help you at all if something happens to it (i.e. you become ill and no longer have the income; you get laid off, etc).

8. C. This is a big problem, which is why putting an up-to-date, signed will in place is the #1 item on the action checklist in my book.

9. 50% – 64%, depending on the demographic. In short, there is a massive wealth gap between men and women. Expressed another way, women have between 36 cents and 50 cents of net worth for every dollar of net worth that a man has, on average. This is the reason that I now do what I do; it’s time to close the gap.

10. D. I also gave a half point for C, because the longer it takes you to pay a bill, the bigger the impact on your score. Most people think that it takes a big amount of money to affect your score. That’s a myth. Any amount paid late will affect your score. At the very least, pay the minimum balance on your credits cards on time. That said, if you’ve been reading my blog, you’ll know that I despise credit card debt. It’s corrosive; it’s nasty. Don’t accept 18% – 24% interest on this type of debt. Make wiping it out your #1 priority, then pay all bills on time every time.

11. One point for B; half a point for A. Ideally, you want to set up regular date nights with your significant other to talk about your finances. Review statements, ensure that you’re both fully conversant with what you own and what you owe, talk about key documents that need to be updated, address any financial issues that life may have thrown at you – there’s usually never a shortage of stuff to discuss. Ensure that you have privacy – kids safely stowed with a loving relative or babysitter – and enough time to get it done without feeling rushed.

12. The point of this question is to get you thinking about the many fees that affect your returns when it comes to investing. Here’s a partial list: brokerage fees, transaction fees, account fees, financial planner/advisor fees (if you think you’re not paying for your advisor, you are dead wrong – there is always a fee for their advice, whether it’s visible or embedded), front load/end fee, back load/end fee, management expense fees (for funds), taxes, etc. If it’s a fee associated with your investments, it counts.

How did you do? Share your results, thoughts and insights below. If, like a couple of the people who attended my book launch, you want me to create a financial literacy quiz for your business, office or organization, just let me know and I’ll put together a customized (i.e. demographic-specific) questionnaire that will get them thinking and talking.

So now that you have the results of your quiz, what are you going to do about it? Over to you.