Financial patterns can be insidious.

Has this happened to you?

Despite your efforts, you find that frustrating financial patterns keep showing up in your life.

Debt you can never seem to pay off.

Savings that rarely happen.

Investments that don’t grow.

Envelopes and statements stacked up in piles that never get smaller.

One day, you decide you’ve had enough of this. You think, “OK, I’m going to get a grip on this. I’m going to figure it out, get stuff organized, put some systems in place, and create some solid goals. Things are going to change.”

Then you get to work.

For a couple of months, you put in the time and the focus.

You tackle stuff you’ve been putting off, go through your statements on a regular basis, increase your credit card debt payments, and pay attention to your spending, making deliberate choices.

It feels good to have all these new habits in place. You’re on a roll! There isn’t a full-fledged system yet, but still, it feels productive.

Pretty soon, you realize that you’re making steady progress. Your confidence is growing. It’s awesome!

The slow slide backwards

Then your kids’ activities start to pick up again. Now you’re back to being a part-time taxi driver for the family, which takes out the Wednesday night you had set aside to work on your finances.

And it’s summer. I mean, who wants to be inside reviewing statements when it’s so gorgeous outside. The season only seems to last 10 minutes around here, so you definitely want to take advantage of that sunshine. 🤷

Your finances get pushed back. You’ll get to them soon, you promise yourself.

Then friends call and want to get together. It’s been sooooooo long since you had a regular social life that you jump at the chance. Who knows if there’s going to be another lockdown. It could happen. Gotta take advantage of the chance to connect while you can.

The weekend slot you had earmarked to work on your finances get bumped again.

And, and, and….

The next thing you know, the summer’s coming to an end, another school year is just around the corner, and you haven’t touched your finances ages.

You’re no longer sure how much you’re spending or what you’ve bought during that time because you haven’t looked at any statements.

You take a peek and your heart sinks when you realize that your credit card debt has crept up. Again.

UGH.

That rut you were determined to climb out of? You’re right back in it, feeling like someone or something else is driving your finances.

The bully in your brain – you know, the internal voice that’s constantly talking to you – is having a field day with this. “You suck,” she declares. “You’re always going to be stuck. See how you failed to stick to your plan? It’s just like you to fail.”

The Yoyo Effect

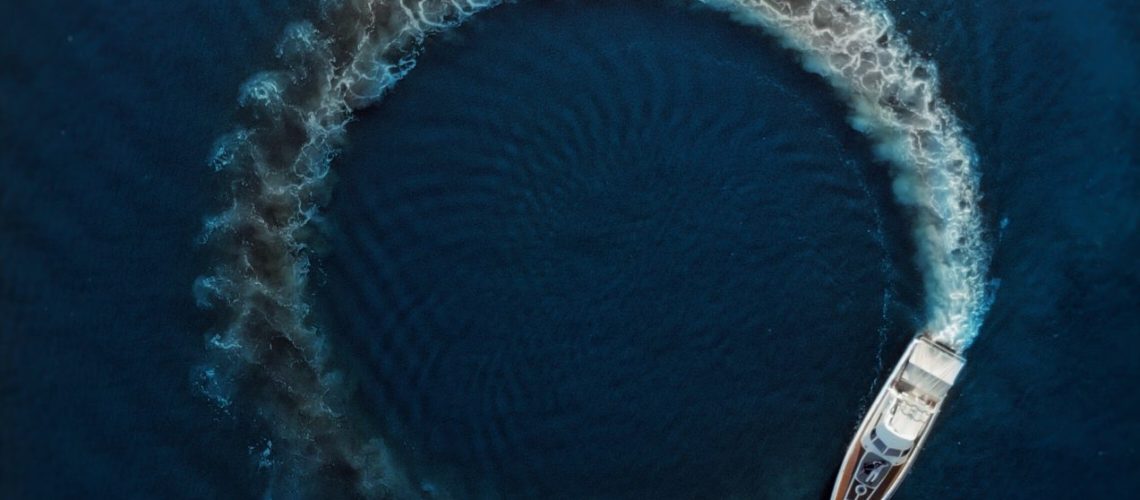

This is what I call The Yoyo Effect, which amounts to taking three steps forward followed by three steps backward in an unending loop that keeps you stuck and makes you want to shout every swear word you’ve ever learned.

I’ve seen this happen with people who wanted to get out of debt, save more money, make more money, and deal with a feeling of financial overwhelm.

They want so much more and so much better, but they just can’t seem to move forward in a way that lasts.

The result is always the same: it feels terrible, discouraging.

The reasons why

When this happens for my clients, there are typically three reasons why:

- They don’t have a clear North Star, a “why”, and a framework to guide their actions. It’s hard to sustain momentum when you don’t have a clear destination.

- They don’t have a holistic, easy-to-maintain system. When the infrastructure is unstable or unwieldy, it’s easy for things to fall apart.

- There are mindset issues keeping them stuck. If your internal script is that you don’t deserve to have wealth, you will unconsciously find a way to keep yourself small, regardless of which system you have in place.

I get it. Years ago I experienced some of this, too. The good news is that there is a solution.

If you find yourself dealing with recurring, unhelpful financial patterns, here are a few strategies to deal with them.

1. Identify your North Star

If you were to write your own obituary, for use maaaaaaany years down the road, what would you say about yourself? (Stay with me here; I’m not being morbid – I promise.)

About the kind of person you were? About the things that mattered to you and what you accomplished with your life?

Don’t focus on the track you’re on right now, think instead about you would want to be able to say about your life.

Who was this great, glorious person that is you?

What did you value?

What got you fired up? Made you lose track of time? Brought you joy?

The answers to these questions are your “why”. They are part of your core values that can act as your North Star when making decisions about your two most valuable resources: your time and your money.

When you know what you value, what really matters to you, and you create goals that are in line with those values, that’s when you ignite a fire inside. 🔥

Nobody needs to remind you of what you care deeply about. You already know that.

When you use that information to create written value statements and you then use those as your decision-making compass, you crank up the joy, meaning, and satisfaction in your life.

You also start to make better decisions about your finances.

Now your money serves you, not the other way around.

If you find yourself not making progress in your life, asking yourself these questions:

- Do I know my core values, my “why”?

- Do I have goals that are in line with those values?

- Am I making choices that are in my highest, best interests?

Answer these questions and you’re off to the races.

It’s not about being debt-free

One of my clients recently said to me that one of her goals is to die debt-free. I immediately shot back, “No it isn’t!” 😱

That is *not* the goal.

I get why she might think that, because there is so much emphasis in the industry about becoming debt free.

Here’s the thing: Being debt-free is not the end result she, or anyone, seeks. It’s simply a step in the process, an item to check off the list en route to the ultimate goal of living a rich, fulfilling, joyful life that fills your cup and that of others around you.

That, my friends, is the bigger goal. Only you can determine what, exactly, that means for you. But I can tell you that it doesn’t mean being debt-free.

Figure out your core values and create value-based goals. That’s step #1 to getting out of the loop.

2. Create an easy-to-maintain money management system

One of the frequent problems I see when it comes to managing money is that people have disjointed “systems”.

They think of their mortgage and house-related bill payments as one group of things to address together, but then credit cards are dealt with separately.

If they invest, that’s another stack of envelopes that they get to on occasion. And saving money? That pops up when there’s a project coming up or when tax season is around the corner and suddenly they’re aware of RRSP deadlines.

There is no big picture strategy that treats all those parts as elements of a cohesive whole that needs to fit and work together.

It’s like thinking that knee pain is all about your knee or maybe the muscles just above and below the knee, when in fact, it’s related to the arch in your foot when you walk as well as your glutes. (How do I know this, you ask? I’ve just come back from my physiotherapist’s office and had an interesting “it’s all part of a big system” conversation. Same principle.)

Here’s how you deal with all those separate parts:

–> Think of money as a river flowing in and out of your life.

What does it need to water on its path through? How much of it simply disappears out of your life without helping anything to grow and thrive?

Money isn’t for spending; it’s a tool to help you achieve your goals. Yes, you spend as part of the process, but that’s not the focal point. You buy good food so that you can nourish your body and be healthy. You do that because it’s a core value and is congruent with your goal of having vibrant health into very old age.

–> Use your core values and your value-based goals, which you have now identified, to determine what to do with your money and in which order.

Most people spend without being strategic about it. Saving and investing happen with the leftovers, and then they wonder why they’re not meeting their goals.

If you take a “leftover” approach to your money, that’s what you’ll end up with. Focus on the things that matter first. Ensure that your money river nourishes your priorities first.

–> Track your money and build review time into your weekly and monthly calendar.

Every week, review your receipts to see what you’ve purchased. Actually look at the receipts to see the line items, not just the totals. That will keep your purchasing decisions front and center.

Did you get great value? Were the purchases in line with your values and goals?

This only takes minutes.

Once a month, spend an hour or two going through all totals and your statements. There are easy-to-use apps like Mint that make this easy.

And yes, review the statements for your investments even if you a) don’t yet understand anything about them and b) they scare the crap out of you.

Remember this: Fear grows in the absence of knowledge. It’s scarier and more harmful overall not to know.

If you don’t know how to do or manage one of the parts of your finances, reach out. I will teach you how.

Abdication is far more expensive in the end than building a financial skill.

When you’re about to blow off a scheduled review time to do something else, ask yourself this, “Is this in my highest, best interests? Is this in line with my values? Am I OK with the consequences?”

Works like a charm for those who value financial security.

3. Identify old stories you’re telling yourself

Most of the mindset issues that plague us come from our past. They stem from the people who raised us, the environment in which we grew up, and the experiences we had along the way.

Important point here: At the heart of my work is my motto – No Shame, No Blame, and No Judgement.

Uncovering the stories you’re telling yourself isn’t about pointing fingers and saying, “You made me believe this nonsense! It’s all your fault.” Not at all. It’s just about identifying the thoughts and emotions that are holding you back.

Mindset work isn’t the kind of thing you can pull off in one sitting. It’s deep work. It takes reflection and awareness.

I wish I could give you a quick and dirty hack to get to the root of mindset blocks and blow them away, but I can’t. What I can do, though, is to suggest that you do the following: pay attention to your emotions, particularly the negative ones.

When you start to feel stress, embarrassment, or any unpleasant emotion around your finances, ask yourself these questions:

Isn’t that interesting? (With this question, you’re distancing yourself from the emotion and treating this as something to be studied, understood.)

I wonder why I feel this way? I wonder where this feeling comes from?

Then sit quietly and pay attention to what comes up for you. Write it down in your journal and keep with it. It may take a while to dig to the root, but you eventually will if you stick with it.

If you need guidance through this process, reach out. It’s what I call the soft but powerful side of money.

And it’s the very thing that most people don’t ever address.

Bottom line

Patterns may be entrenched, but they aren’t a life sentence. You can change them, sometimes remarkably quickly. Follow the steps above and tell me how you make out with it all.

I don’t know ahead of time what you’ll achieve, but I can tell you that with your core values as your compass, you can’t go wrong.

I’ll be opening the doors to my Take Charge of Your Money course very soon.

Be the first to hear about it by getting on my mailing list here.

Get my weekly posts with money tips, strategies, and insights. No spam – ever.

Photo by Sanndy Anghan from Pexels.