If I were to tell you that you can earn 12% quite consistently by investing in private mortgages, what would you say?

If you respond enthusiastically and say, “That sounds terrific,” you’re in good company.

Many of my Women’s Money Group members thought so, too.

I invited a mortgage broker to our last meeting to discuss the pros and cons.

My chat box lit up with private questions during my Q&A with him:

- “Could he find me a deal?”

- “How can I get going?”

- “Should I start doing this as soon as I’m done paying off my debt?”

Hold on a second

Full disclosure: I have been investing in private mortgages, specifically second mortgages, for more than fifteen years.

I have done small deals where I put in $20,000 and I’ve done deals where I invested six figures. Some deals were for residential homes; other were for multimillion dollar commercial projects.

At the moment, I have six figures invested in private mortgages.

I do think that private mortgages are a good investing tool – at the right time, by people who are knowledgeable, and for the right purpose.

That said, alarm bells went off in my brain when I heard my guest wax poetic about private mortgages, with a predictable effect on my Women’s Money Group members.

Who wouldn’t have FOMO when you hear stories like, “I’m making 12% all the time and have been for years.”

There’s a lot more to the story than that

It’s not so simple. There are critical nuances to consider.

I get how enticing thoughts of 12% returns are, but I want you to pound hard on the brakes with both feet if you’re thinking of investing in private mortgages until you’ve read this article and completed my checklist.

If you still feel all-systems-go about private mortgages by the end, then have at it. I genuinely wish you well.

12% is not what you think it is

Let’s start by debunking the biggest attractor to these types of deal – that percentage rate.

When you hear that a deal has a projected “12%” return, you’d be forgiven for thinking that you definitely want some of that action.

But you need to understand what that 12% really represents.

It is 12% simple interest. Not compound interest.

Compound interest is the magic sauce in returns. Simple interest can’t hold a candle to compound interest over time.

In a second, I’ll show you a straight up comparison of the two, but first I want to share my experiences over more than fifteen years of investing.

I have seen many people with deals in hand mistakenly present private second mortgage returns as compounded instead of simple interest.

That’s incorrect.

I have never seen a second mortgage deal presented that did not involve simple interest. First mortgages may involve compound interest, but second mortgages? No.

Here’s why that matters.

An example

Let’s say you have $50,000 to invest. You’re aware of the research on the stock market and you’ve been planning to invest your money in a simple, low-cost, well diversified, balanced portfolio of index funds.

But then along comes a second mortgage deal with a return of 12% interest and you think, “Why on earth would I settle for market returns over the long term, which are much lower, when I can get 12%?”

It seems like a no-brainer!

Despite the fact that you have little experience in real estate and you have to take the broker’s word that this represents a “good deal” (mostly because you’re not sure how to evaluate the property or the borrower), you park your money in the deal for a five-year term – which is an unusually long term for a second mortgage.

I’m going to slant everything in your favour for the purpose of this (fairy tale) analysis.

Lucky for you, the deal turns out to be a good one and everything works out as planned.

After five years, here’s how much you’ve earned:

$50,000 x 12% simple interest = $6,000

$6,000 ÷ 12 months = $500 per month

You’ve received 60 monthly cheques of $500 each over a period of five years for a total of $30,000. At the end of the deal, you get your $50,000 back. You now have $80,000 instead of $50,000.

“This is awesome!” you think. “Let’s do it again.”

You reach out to your broker and ask for another deal just like that last one. It takes a couple of months to find one, but eventually you do and lucky for you, it’s another five-year term.

And in my everything-goes-smoothly-for-you world, we’ll assume that every deal works out, without any hiccups, and that you get paid on time, in full, every time (a girl can dream).

We’ll also assume that you always find the right deals for you with only two months of downtime for your money after every term. In addition, you invest for a total of twenty years (plus six months of downtime).

What the math shows

After 20.5 years of investing continually in private second mortgage deals with 5-year terms, earning 12% simple interest, and only 2 months of downtime between every deal, you would have a total of $180,000 –> $50,000 of principal plus $120,000 of interest.

Let’s ignore whether these investments were done inside a tax-sheltered account, or not, for the moment. I’ll get back to this.

What if you had followed through with your plan to invest your money in a well-diversified portfolio in the stock market instead of chasing the private mortgage?

Here’s what you returns would be:

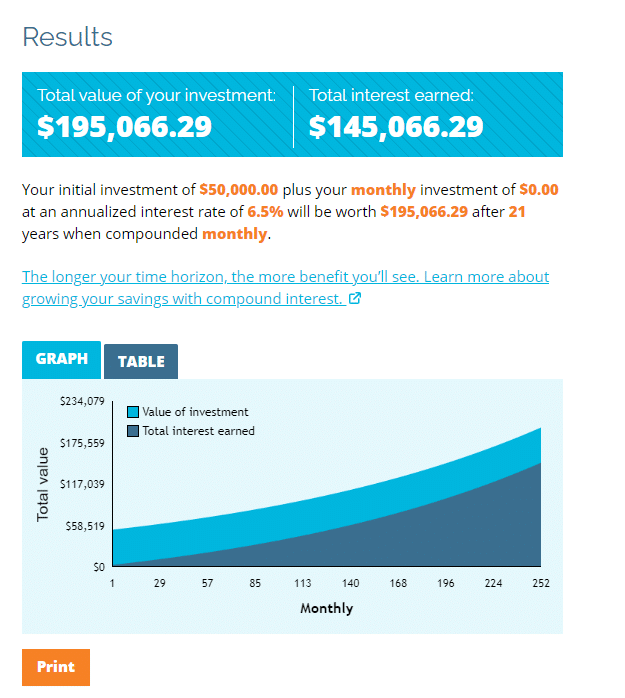

I’m using a 6.5% average annual return and not another penny added to your initial $50,000, using this compound interest calculator:

Total dollars in hand at the end of 21 years = $195,066.29.

I can’t get the calculator to use 20.5 years instead of 21, but even if you eliminate six months of compounding, you are still much further ahead with this approach.

And – this is important – with a fraction of the work and the risk.

The impact of taxes

If the private mortgage were done inside a tax-sheltered account such as an RRSP, then taxes wouldn’t apply.

However, if you either don’t have the funds available in your RRSP or you don’t have the room, then the investment would be exposed to taxes.

And that’s where interest income loses further ground to income from a broadly diversified portfolio. The returns for the latter comes from a mix of interest income, dividends, and capital gains.

Outside of tax-sheltered accounts, interest income is fully taxable at your marginal tax rate. In other words, it is added to your income for tax purposes in the year in which you earned it.

If you have a 40% marginal tax rate, then the tax bill on $6,000 of interest income would be somewhere in the ballpark of $2,400. That amounts to roughly $48,000 eroded from your returns over the 20-year time frame.

With a diversified, balanced portfolio, you would also generate some interest income, but not a substantial amount. You would also have paid a bit of tax for any dividend income you incurred. The bulk of the growth, though, would be from the increased value of the stocks in the funds. You do not pay capital gains on those – which are taxed at a preferential rate – until they are realized (i.e. when you sell the funds).

The gap in returns is now even wider.

Score another win for the index-based, stock market approach.

Bottom line:

Even when I unrealistically slant all the conditions in favour of the private mortgage investments, the returns are still lower than stock market investments that require nothing more than occasional rebalancing.

This despite the fact that in my example, the stock portfolio has roughly half the average annual return than the private mortgage.

That, right there, is the power of compound interest in action, not to mention the attractive fact that the index-based portfolio requires no deep expertise, analysis, vigilance, increased risk, and downtime searching for another suitable deal.

Private mortgages are risky

I grant that first mortgages represent a relatively low risk, assuming that the property is attractive, in good condition, in a good location, and desirable to a lot of buyers in the event of default by the borrower.

However, given that private first mortgages yield roughly the same returns as the low end of the stock market portfolio I’ve just mentioned, why would you go this route? It’s so much more work. After a few years, you have to go through the process of due diligence and document preparation all over again.

For my money, first mortgages represent too little return for the work involved.

Second mortgages do have higher rates of return, but they’re risky. Successful mortgage deals require an understanding of the risks, which include:

-

- The borrower. What’s their credit profile and credit history? Do you understand how to evaluate that?

- The property. What would it mean to you if the borrower were to default? How likely would you be to see your money back, forgetting about any profit? How long would it take? Is there enough equity in the deal to act as real security?

- The loan to value. How much equity does the borrower have in the deal? The higher the LTV, the riskier the deal and the less likely you’ll see any money back if the deal goes south.

- What’s the first mortgage? Is it a conventional mortgage or a collateral mortgage? If it’s the latter, I strongly advise you not to touch the deal. I wrote a 3-part blog series on collateral mortgages and the danger they pose to investors. Please read it before investing in a second mortgage deal.

What can and does happen in real life

Here is just a partial list of things that can and do go wrong with second mortgage deals in real life – and not in the fantasy scenario I created above:

- Borrowers incur even more debt from unanticipated expenses. Suddenly, they have trouble keeping up with the interest payments. As a result, they miss some payments and you have to chase them. In other cases, they stop paying altogether.

- The plan doesn’t go as expected and in two years – a common length for a second mortgage term – they are unable to pay you out. That doesn’t at first sound so bad from an investor’s perspective, since you’re collecting interest, however you soon come to realize that their financial situation is deteriorating. They might not be able to keep paying. Now what do you do?

- When the borrower stops paying, the first mortgage holder initiates legal proceedings and the equity in the deal quickly gets chewed up with fees and unanticipated costs. When all is said and done, there are insufficient funds to cover both the first mortgage loan and the second mortgage loan. As the second mortgage holder, you lose.

- Even when the property is in a great location, it can take a long time to secure a sale. People who are bailing on mortgage payments may not take the best care of the property or leave it in great condition. Costs to clean up and prepare the property for sale mount. So do the headaches and the stress to get the work done.

- Second mortgage holders don’t want to keep paying high fees, so they typically build in early repayment clauses. When they pay you back early, it means that you’re getting a fraction of your anticipated returns for all the work.

- Finding good deals is not a smooth, linear process. It can take time. Your money will waste productive time sitting in your account while you wait for a good deal. The wait can be short – one month – or it can be long – several months. Sometimes, people offering deals face unexpected delays in paperwork. It happens. Meanwhile, your money sits in your bank account losing purchasing power with every passing month.

A checklist before proceeding

If you still think you’d like to explore private mortgages, here is a checklist of the steps I would recommend you take before investing:

☐ Create a list of your investment goals. Why are you investing? How much do you need to accumulate and by what date? Why?

☐ Determine your Investor Profile – the amount of risk you’re comfortable taking. How much risk do you need to take on to accomplish your goals while still being able to sleep at night?

☐ Create an Investment Plan, complete with a list of the asset classes you will hold and in what proportion (your Asset Allocation).

☐ Decide on your Asset Location. Which accounts will you use for which assets? Why? (You need to be able to articulate the “why” behind your plan.)

☐ Determine where private mortgages fit into your plan. If they form a part of your Fixed Income asset class, can you explain to yourself why you’re willing to take on higher levels of risk in an asset class that is generally used to mitigate risk?

☐ Educate yourself on investing in private mortgages. Read broadly, interview multiple investors, and seek counterpoints to your opinions. Don’t take a mortgage broker’s word on the strength of a deal. Know how to evaluate a deal yourself.

☐ Learn about borrower risk. That means understanding Credit Bureau Reports, including both credit scores and credit histories.

☐ Understand the real estate market in which you wish to invest. What are the average days on market for a property? Which properties sell well and which take longer to sell? Which locations have negative influences (e.g. drugs, gangs, etc).

☐ Assemble a team of professionals you trust, including a lawyer who has extensive experience with private mortgages, an experienced mortgage broker, and a Realtor you trust. Interview prospective team members until you find the right fit for you.

☐ Read my article on collateral mortgages and understand the basics of mortgages.

☐ Finally, do an Opportunity Cost evaluation of the funds in play. What else could you be doing with them? Is there something better that would line up with your core values and your plan?

A final thought

Private mortgages represent a small percentage of my overall portfolio. They are not part of my core plan, for which I use the bulk of my money.

My husband and I recently had a conversation about whether or not to do any deals in the future when our existing deals mature. The verdict isn’t in on that one yet.

Whatever you do, please be careful. I can tell you that you can build great wealth in simpler, more effective ways if you choose to.

Don’t get pulled in by hype, FOMO, and impressive-sounding numbers. As I said earlier, there’s more to the private mortgage story than meets the eye.

Want to learn more about my WOMEN’S MONEY GROUP? Click here. The WMG is a country-wide community of women connecting to learn about money, discuss, build confidence, and cheer each other on. We meet online every month.

Get my Money Tips sent straight to your inbox. Join my mailing list here. No spam – ever.