Last year, for my Women’s Money Group, I offered a workshop on the best credit cards available at that time. I created a spreadsheet of more than a dozen options and did a deep dive on their respective offerings, including the value of their points systems.

One of the no-fee cards that stood out was the Tangerine Mastercard.

Tangerine had a number of attractive offerings in terms of accounts, so I thought I’d run an experiment – become a user and do a “compare and contrast” with the Simplii (previously PC Financial) no-fee chequing account and the President’s Choice Mastercard combo that I’ve been using for more than a decade.

This past June, when I did a review of our personal financial organization system, I decided to part ways with Tangerine.

Here’s a look at some of the factors that played a role in my decision.

Automation hassles

One of the first things that I teach my clients is to automate key parts of their finances, including bill payments. This is to ensure that you don’t miss a payment because life got in the way.

As soon as I received my Tangerine Mastercard, I logged on (more about that experience in a second) to set up pre-authorized debits from my Simplii chequing account, which I have had for as long as I can remember.

No can-do.

You can set up automatic payments from your Tangerine Savings account or your Tangerine Chequing account, but you can’t use an account outside the Tangerine ecosystem.

WTH?! Why, Tangerine? Why limit my options? I don’t get why it matters which bank account I use to pay off the card.

At that time, I grumbled about it to my husband and set an electronic reminder to go into my Simplii account to pay off the amount owing using the Simplii Bill Payment mechanism. Since I had committed to a year-long study, it was my only option outside of setting up a chequing account in Tangerine.

Here’s what’s interesting to me about this situation: Over the years, I have had cards from many of Canada’s major lenders – an RBC Visa, a TD Visa, two American Express cards (one of which I have to this day), a Scotiabank Visa, a Rogers Mastercard, and my PC Financial Mastercard.

I set up automated payments for every one of these cards using pre-authorized debits from my Simplii chequing account.

Tangerine is the only one that does not permit this, to my knowledge.

Strike one against Tangerine.

Why not set up a chequing account?

You might ask the obvious question – why not switch my chequing account over to Tangerine?

A couple of reasons pop to mind.

First, my husband and I have multiple joint accounts – for our personal use and for our personally-held investment properties. There are dozens of automated payments set up across those accounts when you consider mortgage payments, property tax, insurance, condo fees, rent payments, credit card payments, utilities bills, and so on. It would be a major PITA to change accounts.

The reason to move would have to be hugely compelling to make us tackle that much work for the switchover. It’s just not worth it.

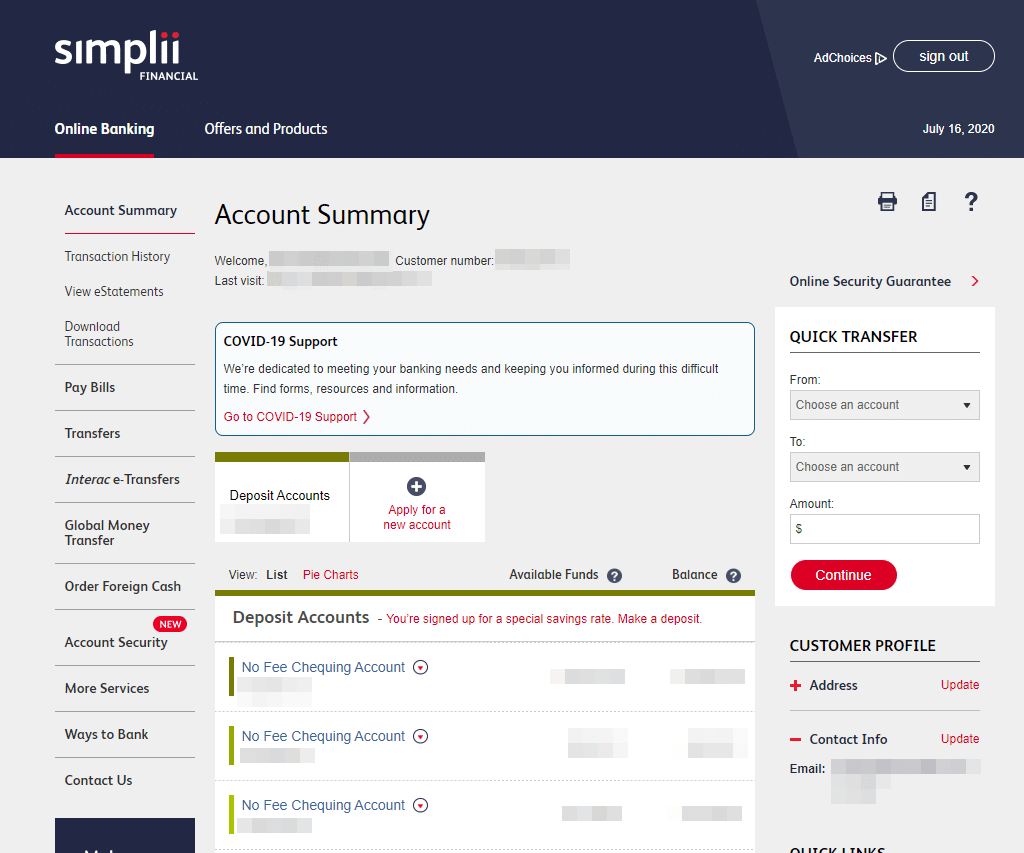

Second, I really like Simplii Financial’s dashboard.

I see all my accounts at a glance, and the top services I need are in an easily accessible menu on the left.

Want statements? Pay a bill? Send an e-transfer? All links are immediately visible and one click away.

It’s not a pretty dashboard, but it’s effective. I care about the latter a great deal more than a cute presentation.

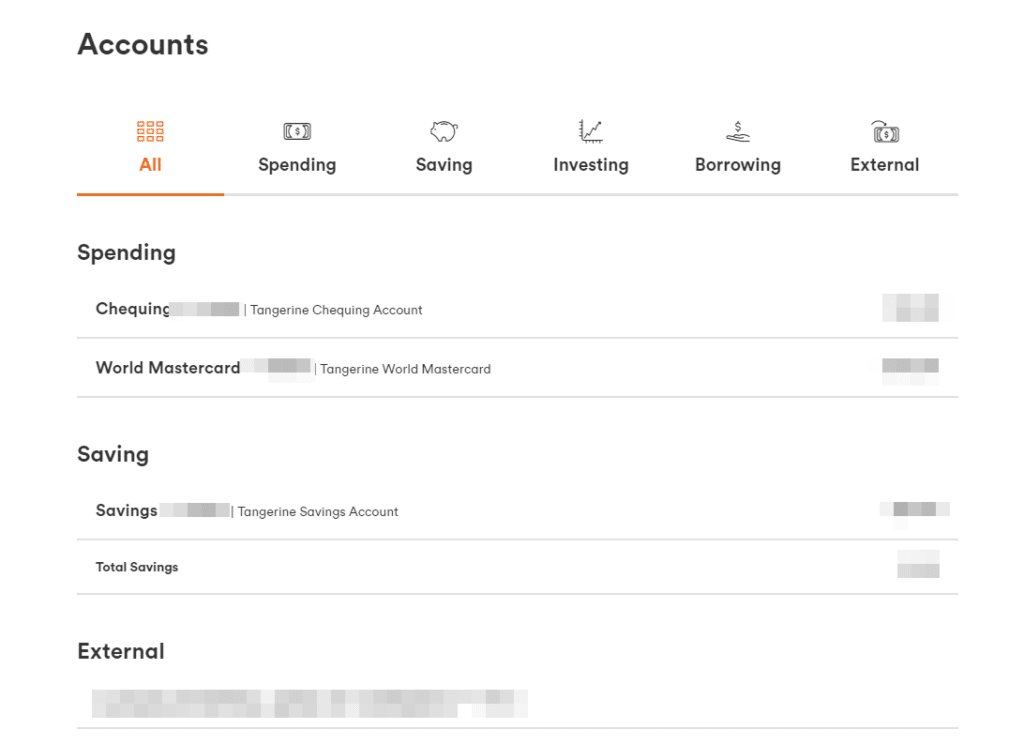

Tangerine, by contrast, looks prettier, but doesn’t have the same transparent functionality. Check out the dashboard:

If I want to send an e-transfer, there isn’t an immediate link on the dashboard. I have to click on my chequing account, then click on “Email Money”, then enter all the details. It’s not as quick and obvious as Simplii’s system.

The latter is a smaller point and most people may not care, but because I’m in my accounts a lot, the small conveniences add up for me. I’m a big fan of systems that save me time and make it super simple for me to get where I need to go in a hurry.

Interest Rates

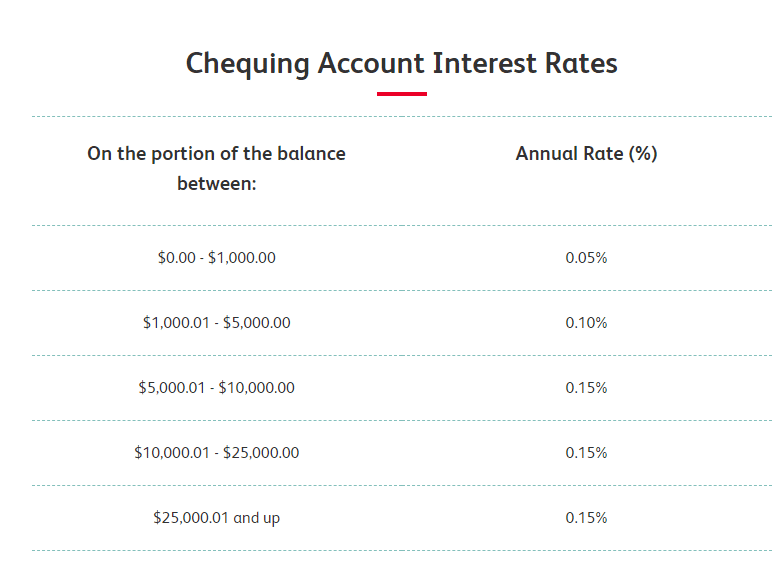

I should mention that Tangerine offers a tiny bit more interest on dollars in the chequing account than Simplii does.

Tangerine pays a flat rate of 0.15% (at the time of writing) whereas Simplii has a sliding scale based on your account balance:

At most, there’s a 10 basis point difference – or one tenth of a percent. That works out to less than $4 annually. I can live with that.

Strike two against Tangerine.

Log In Pain

After the pain in the backside of not being able to automate credit card payments, this is the second biggest killer of the deal for me.

The log-in process for Tangerine does not work well with password managers.

Malwarebytes.com provides a great explanation of password managers:

A password manager is a software application designed to store and manage online credentials. Usually, these passwords are stored in an encrypted database and locked behind a master password.

In other words, it’s an application that auto-generates secure passwords for you, stores them, and auto-populates log-in information with a click or two. Instead of creating a ream of insecure passwords that you then have to remember, you create one master password and the password manager does the rest for you.

My husband, Mark, and I use LastPass for our personal and business worlds. It cranks up our online security and saves us a heap of time by filling in all the fields automatically once we’re logged in.

I resisted using a password manager for a while, until Mark set it up on my computer and demonstrated that it takes precisely 10 minutes to get it up and running (my bad). Once I started using LastPass, I was hooked. It was so much faster and infinitely more secure!

Cue Tangerine

The first time I logged in to Tangerine, I discovered to my dismay that it doesn’t work with password managers. And, as Mark pointed out, it’s cryptographically insecure.

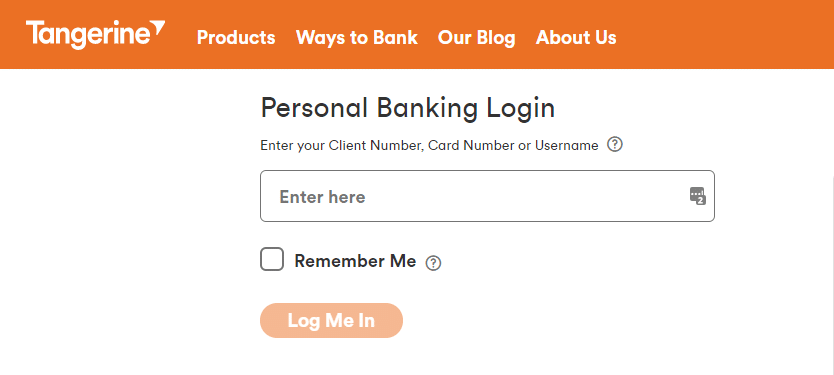

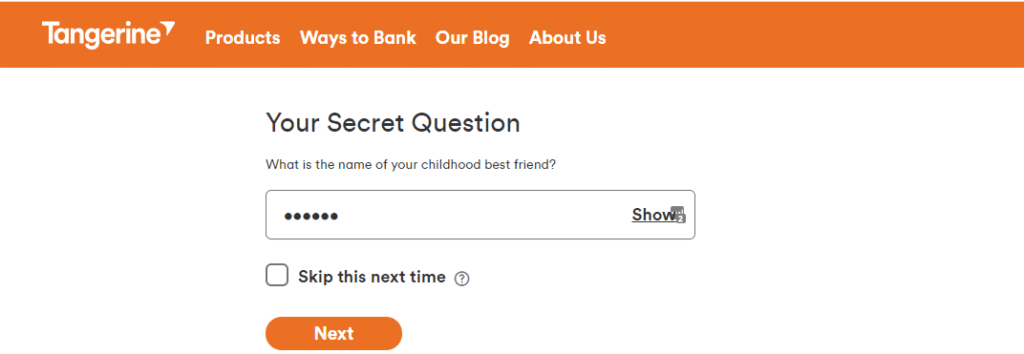

Here’s the first field you see when you log in at Tangerine:

So far so good. You can see from the small gray square with the dots inside (in the “Enter Here” field) that LastPass recognizes the log in. It’s ready to go with my Username when I click on it. Terrific.

Not So Secret

Once that’s done, you see this:

Two things here.

First, Lastpass has auto-populated the field with the pin number (more on that in a second), however that’s not what Tangerine is asking for. They want you to answer a “Secret Question” before you can put in your pin.

Password Managers are designed to work with two fields, not three (there’s a third one coming up – see below). Another strike against Tangerine.

Second, this is what my spouse likes to call security theater. The answers to almost all secret questions can be found on Facebook and other social media accounts, unless you do what he does and make up ridiculous phrases like “MyCatHasThreeExhaustPipes” instead of answering the question.

Not So Secure

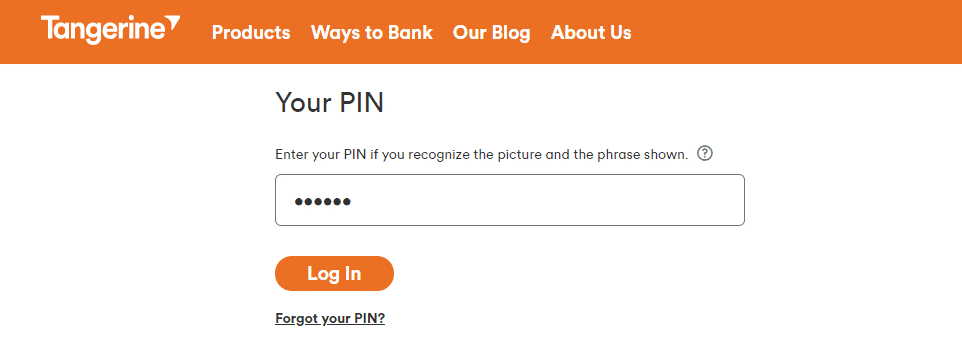

When you get past this window, here’s what you encounter next:

Now you need to put in a 4-6 digit pin. That’s it – just four to six digits.

Mark, who is an IT Consultant, did a presentation for my Women’s Money Group in which he shared that 16 alphanumeric characters with a mix of upper case, lower case, numbers, and special characters is considered the minimum length you want to aim for. A twenty-character password is even better; it’s considered secure, especially when combined with two-factor authentication.

That’s a long way from four to six digits, which is easily attacked.

Additionally, LastPass doesn’t recognize the PIN field as a password field. I have to grab it from LastPass, copy and paste it into the field every time, which eliminates some of the convenience of having a password manager.

Strike three. Tangerine is out.

Cards and Accounts Should Serve Your System

When I created a money map of my organizational system, it was easy to see what was working well and where the system bogged me down.

The picture that I drew during my June review revealed three key things about my current system:

- Tangerine was causing delays and hassles right out of the gate at Log-In.

- It was preventing me from setting up automated payments, which are central to my money system.

- It made life harder, not easier. That usually means there are better options on the market.

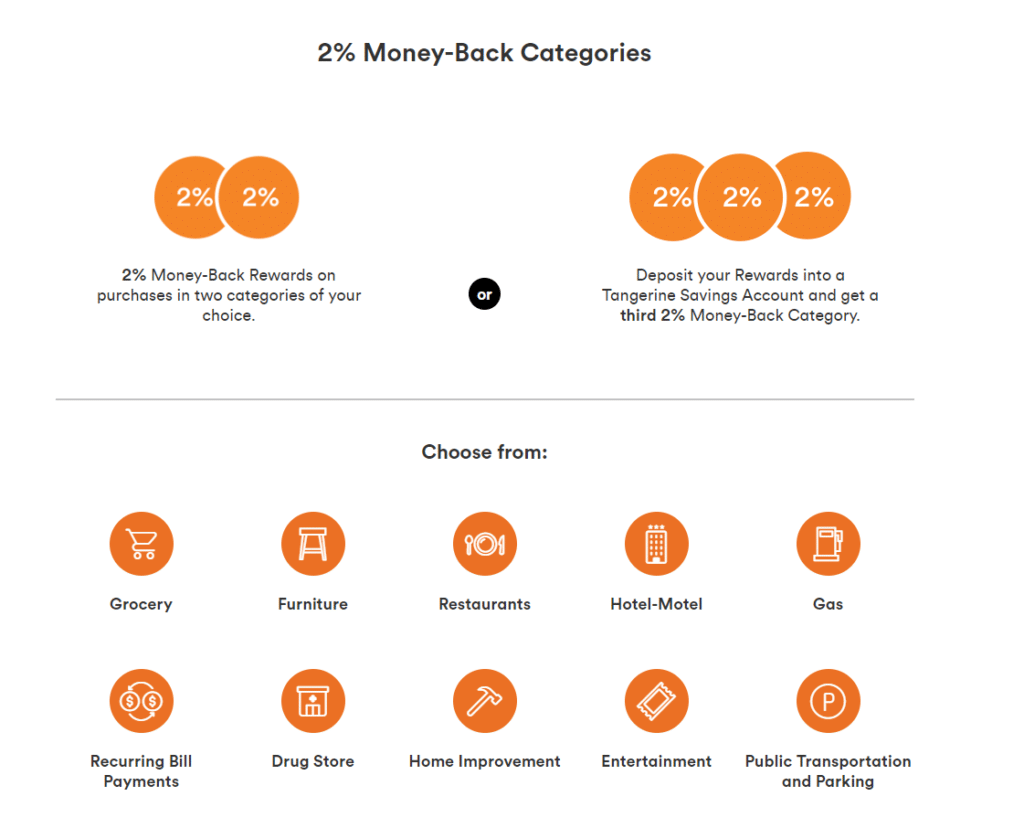

The credit card definitely has some attractive features, such as offering 2% cashback in two or three categories, depending on how you set it up.

Tangerine Mastercard

PC Financial Mastercard

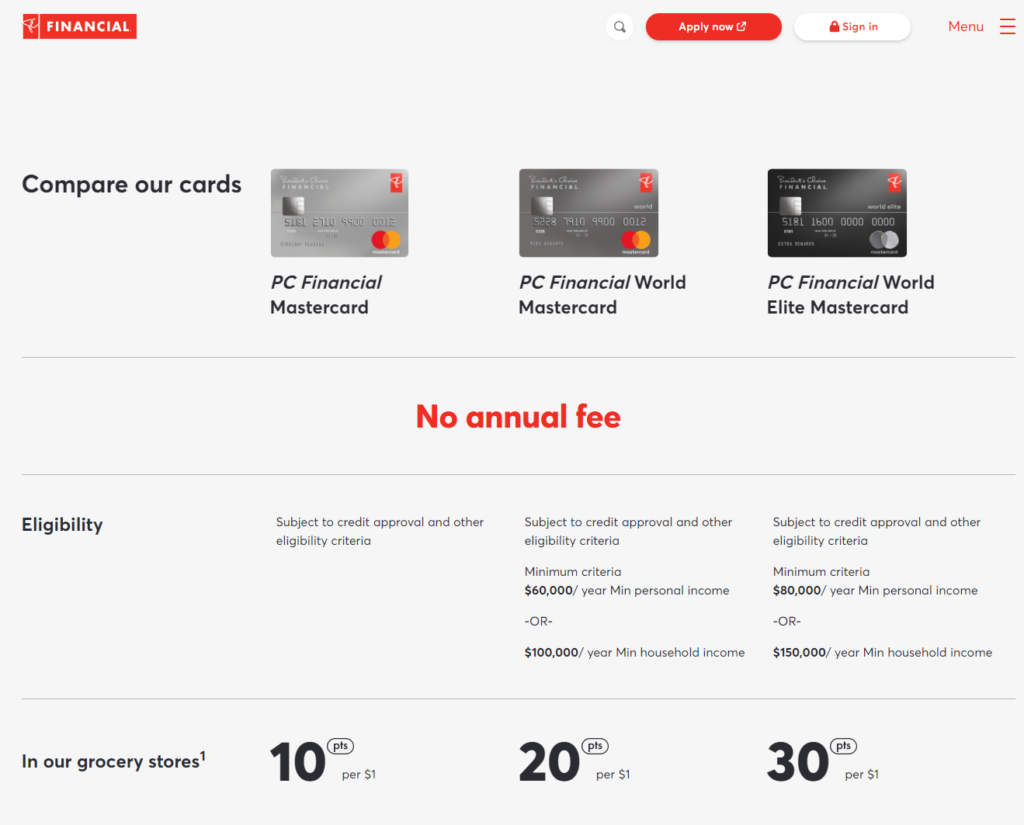

Our PC Financial Mastercard, on the other hand, optimizes returns on purchases made in their stable of stores. The amount of value you get also depends on the card you have.

When I did the rough math on our purchases, we are walking away from a few dollars, but not that many given that we do a lot of shopping in the stores covered by the PC Financial Mastercard, and we get 30 points per dollar spent for our particular card. For us, that translates into a lot of free groceries.

What Tangerine Does Well

To be fair to Tangerine, there is one area where they are leagues ahead of Simplii Financial – their savings account rocks!

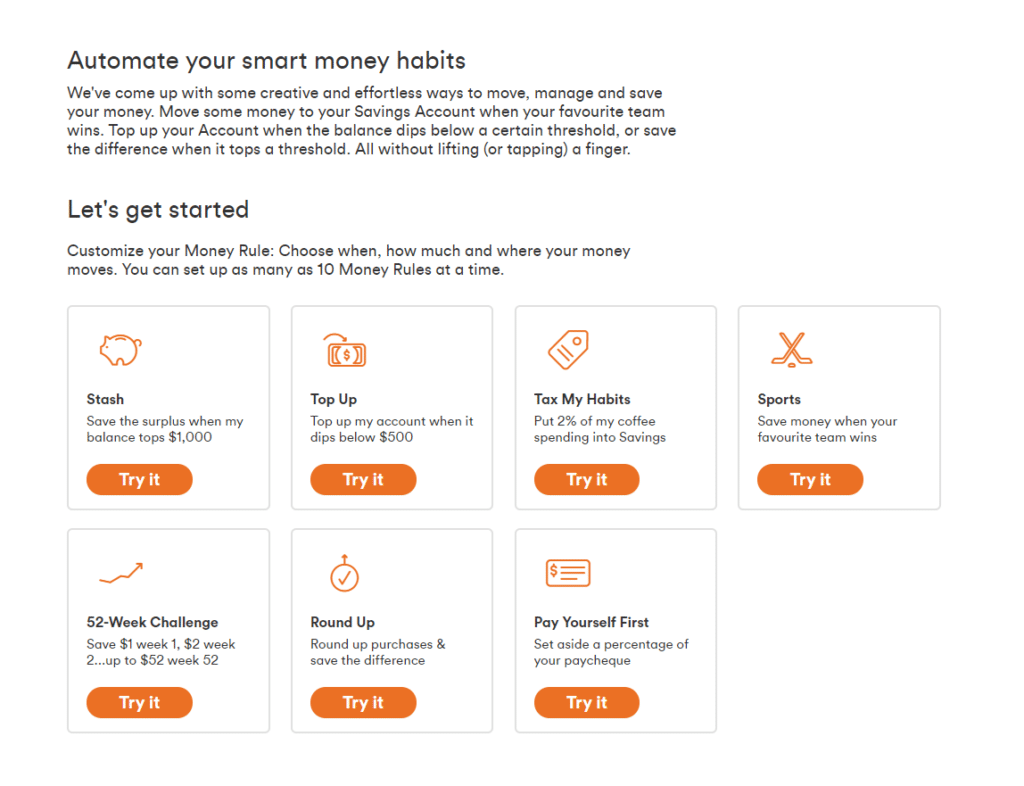

It helps you do one of my favorite things – automate saving money, and they offer up a variety of clever options to help you accomplish that. Check these out:

So smart! I lovelovelove the options here and the reporting that comes along with these options (these are also available on the spending side through the chequing account).

Any savings account that helps you save more money, more easily, gets my vote.

It’s just a shame that I can’t get behind the rest of their offerings for the reasons outlined above.

Bottom line

I will continue to recommend Tangerine to my community for its savings account.

And hey, if Tangerine is floating your financial boat, then don’t change a thing.

However, for those who, like me, want to set up a simple, automated, secure, time-saving system that helps you achieve your goals in the best possible way, Tangerine isn’t it.

I will stick with Simplii for my online chequing account and with the PC Financial Mastercard/Marriott Bonvoy American Express card combo for now.

I’d love to hear what you’re using for your online banking and credit card system, and why. Pop a comment below!

Want to receive my weekly money tips and strategies?

Don’t miss a thing! No spam, ever.

23 Responses

Fantastic post! What a great analysis, it’s exactly what people need to see when they are deciding where to bank. Thanks,

Thanks, Judith! I’m glad you enjoyed my post. I appreciate this all the more since it comes from another money gal! Thanks for popping by.

Thanks for the great review! I use Tangerine for savings, CIBC for day-day banking (dashboard is almost identical to Simplii), and Wealthsimple for additional savings/sinking funds. I completely agree with your review – Tangerine can be a pain to use, but I really appreciate the savings programs it offers. I hadn’t considered the ‘security theatre’ concept before – and now that you mention it, it’s so true! I’d love to hear what you think about Wealthsimple in a future post!

Hey Victoria, thanks for sharing your choices. Tangerine definitely has some good savings programs. As for Wealthsimple, I’m exploring a few of their offerings. I’ll chime in when I have more info on how they roll.

Thanks for your summary. I love seeing comparisons that I can share with my clients which gives them more opportunities to save money and time in a well informed manner. Well done.

Thanks so much, Janet! I love that you’re always on the lookout for helpful information and tools for your clients. Good on you.

Hey Doris. I’ve used simpli for over 20 years now for my checking and savings account. I really do love how they don’t have any fees but I wish the savings account offered a better rate and sometimes it can be a pain when you can’t actually just walk into a branch for help, like when I need American money. Last year I was debating over the simpli credit card and ended up going with an RBC west jet one to get free flights Which seems silly now because we can’t go anywhere lol 🤦♀️

Hey Megan, it’s great to hear from you! I hear you about your travel card. We’re in the same boat with our American Express Marriott Bonvoy card! At least we can use points for hotel stays, which will come in handy as we discover our province in this summer of local travel. Still though, it’s not the same, is it? It will be interesting to see what happens with travel rewards cards if the pandemic-related restrictions go on longer than expected. Will more people move to other cards? Great point. Thanks for bringing that up.

As for Simplii’s savings accounts, they’re not at all great, which is why I don’t use them. We use EQ Bank’s high interest savings accounts instead. Since both are online, it doesn’t much matter to us where the accounts are. And you’re right that a purely online bank can be a hassle when you need something out of the ordinary, like getting American dollars. If that were something you needed on a regular basis, it might make sense to pay for a Big 5 bank account.

Thanks for popping by. It’s always a pleasure to hear from you. Stay healthy!

I strongly suggest to not sign-up for Tangerine accounts, even though their high-interest savings account along with their sign-up bonus rate offer are very tempting. Why you’d ask? it’s just simply not secure, as mentioned in the post above Tangerine uses 4 or 6 digit PIN instead of a password (major red flag which I overlooked). Also, answers to their security questions are easy to guess for a lot of people (mine weren’t) and can be found out through social media and other sources.

Today someone somehow got access to my new Tangerine Visa Debit Card which was still in the mail via Canada Post or maybe they stole it from my building mailbox after it was delivered. They were able to then call in Tangerine and get the new card activated, CHANGED MY 6 DIGIT PIN and reset all my security questions (Tangerine says they verified my account info before doing all of this). I, out of the blue get an email alert from Tangerine saying that my PIN was changed to which I immediately called Tangerine to see what’s going on.

While I am on the call, the fraudster was able to access my account at a Scotiabank ATM and transferred $3000 from my savings to the chequing account and withdrew a $1000(daily limit) from the ATM. Again, all of this happened while I’m on the call with the Tangerine rep. who even locked my account but was apparently still accessible via an ATM(bad security implementation).

Obviously, I was panicking and tangerine was bouncing me back and forth between the Customer Service and Fraud department (which for some reason was not accessible when I called ). After somehow being able to speak to the fraud dept. they took note of all the information and said they are going to investigate the incident and it will take 5-10 business days to resolve the issue and if it is found that it was fraudulent activity, they will reimburse the stolen funds. I have reported the incident to local police and informed both the credit bureaus and now waiting for tangerine to investigate and resolve the issue and give me my money back.

TLDR – DON’T USE TANGERINE.

Thanks FS for sharing this with us. That’s a sobering story. Please pop back in to let us know how Tangerine dealt with this issue. Good luck with this issue. I empathize with how stressful this must be.

Thanks for the information!

I’m currently with Tangerine but now I’m considering switching after reading your very informative post. In your opinion, for someone who doesn’t meet the pay grade requirements for many of the popular credit cards. Would you recommend the PC MasterCard for daily transactions?

Hey Lindsay, Thanks for popping in. Glad you found the article informative.

As for your question about PC M/C, without knowing more about where you tend to shop and whether or not you qualify for their second-level card, it’s hard to say, but I suspect it’s not worth switching. Their basic level M/C doesn’t give you a great return, even if you shop in their stores. You can definitely do better elsewhere.

I suspect that it makes sense for you to stick with the Tangerine card for now, despite what I say in the article. The fact that you can personalize the categories to maximize points is an attractive feature.

I hope this helps!

Hello,

Thanks for sharing this. I confirm the issues with LastPass, as you have described. It’s such a nuisance! However, the issue that concerns me most is the login security problem you have mentioned. I cannot believe that they have been able to get away with this for so long! In my view it’s completely insecure. These days, when hacks, attacks, viruses and fraudulent actions of employees abound, to rely on a password (sorry, PIN) 6 alphanumeric digits long is a joke. ALL these passwords (there’s not many of them) have been decoded and available for free on the Internet. All it takes is access to the passwords table in their database and the security is out the window. Security questions?? As your husband says, that’s even a bigger joke. (I have created random answers with LastPass, but most people have real, honest answers to those questions). Tangerine doesn’t even a two factor authentication process. I keep my Tangerine credit card because I rely on the zero liability and their 2% money back, but I am constantly looking for another credit credit card to replace it with.

Hi Bogdan, Tangerine recently sent me the following email with the subject line “We’ve made some changes to your login experience”:

IMO, this does nothing to make the login experience saner, nor does it address the security issues I, and many other people, have raised. Let’s wait and see what they mean by “2-Step Authentication”, but I’m not holding my breath. I’m afraid even if they did suddenly make the process more secure, I’m not sure I’m willing to trust a bank that thought a 6-digit PIN was a smart way to go in the first place.

As for the credit card, their 2% money back guarantee is attractive, but not unique. My PC M/C gets me 3%. Granted, there’s an income requirement attached to that, but if you meet the criterion, the card is a good one. Where Tangerine has the upper hand is that it lets you pick two or three categories (depending on the card) to prioritize for higher cashback levels. PC doesn’t offer that.

For me, the PITA factor of having to pay the Tangerine credit card with a Tangerine chequing account was a deal-breaker, regardless of how good the return is. This is where you have to evaluate the pros & cons for yourself in deciding whether to stay or break up with Tangerine.

Thanks for sharing your thoughts!

Thanks for the information about the login process. That piece of information is preventing me from creating an account at Tangerine. The one thing that is preventing me from opening an account at Simplii is alerts. I want an alert on all transactions (deposits and withdrawals) but surprisingly most banks don’t support this.

Hey Steven, I’m not aware of any bank that will provide alerts for all transactions. If you’ve found one, can you please share here for my info? Would love to know.

I’m curious: Why do you wish to get such detailed oversight on the activity of the account? Are you concerned about a joint user or is it security concerns in general? Something else?

Thanks for dropping by!

Currently to my knowledge only BMO and RBC offer this capability. This is for primarily for security. I have had this on my credit card for so long and proved to be valuable to recognize fraudulent transactions. I have certain pre authorized withdrawals that are variable amounts in nature. I like to be aware of anything that comes out of my account and not rely on any banks fraud detection to notify me. I don’t want a surprised compromised debit transaction where I may not notice for days/weeks later.

Thanks for the details. I can see the justification for paying monthly fees to a bank if that level of oversight brings you peace of mind. Personally, I’m quite fond of the no-fee option and, knock on wood, have never had any security breaches with my chequing account.

Had you asked me about Tangerine’s offerings several months ago, I could have checked them out for you, but I’m not sure at the moment as I’ve dropped them. If you a reference to the service in their product description, then it’s doable.

And Tangerine claims to have this capability but I don’t have a Tangerine account to verify.

Maybe Simplii has fixed all the website issues they had a few years ago. I left them because of those issues. Some of your comments about the Tangerine website seem incorrect (e.g. EFT link not on the main page). I have also found Tangerine very responsive to feedback (website and app), unlike most other Canadian banks. I only left Simplii because they ignored feedback from me and others on their interface and functionality (e.g. joint account holders not seeing each others pending transactions on the joint account) and their (then) horribly designed non-intuitive website. I had/have a list of issues I documented. They have probably fixed all or some of them I imagine. Thanks for your detailed analysis. I may look at other options if Tangerine ever fails me.

Hey Tug, I’m glad that Tangerine is working for you. I have not had a good experience with them, nor have several of my clients. No service/product provider will work for everyone.

If Tangerine is working well for you, then no need to switch.

I have been using Simply since it was called something else 🙂 I have never had any issues with them. I did have a fraudulent transaction take place on my account (my fault for using a stupid simple password – not any more!) and they quickly fixed everything. One transaction did take about a month to sort out but I kept after them and they did eventually get it done.

I really had the two-factor login authentication for Simpli now but I know it’s for security purposes. It’s just annoying that, on my home computer that I use all the time, I have to go to my phone to get a security key every single time I log in.

Hi, I’ve opened an account with each, starting with Simplii.

With Simplii, I don’t like the fact that there are no alerts on transactions, that the debit does have VISA, and that I had to call them 4 times in the process of setting up my account because of errors and omissions on their website.

With Tangerine, I get my alerts, but cannot transfer money using an email account. I ended up having everything set up faster with Tangerin, mainly because of their automated account validation processes.