“Doris, what should I do first?”

That, in a nutshell, is the most frequent money question women ask me as they seek to fix money problems or take their finances to the next level.

The reasons vary. Some women need to figure out a complicated situation post-separation or after a financial trauma, like the loss of a job or a bankruptcy.

Others are in a good place, with a strong income and no debt, and now they want to make better use of their money to get even closer to financial freedom.

What they all have in common is their question: Where do I start?

Consider the most recent example of this – a message from one of my Women’s Money Group members who said:

[One of your blog posts] discusses focusing on one financial goal. What are examples? What comes first, as everything is interrelated? Is there a hierarchy of financial success?

Great questions! I love the way she phrased that – a hierarchy of success.

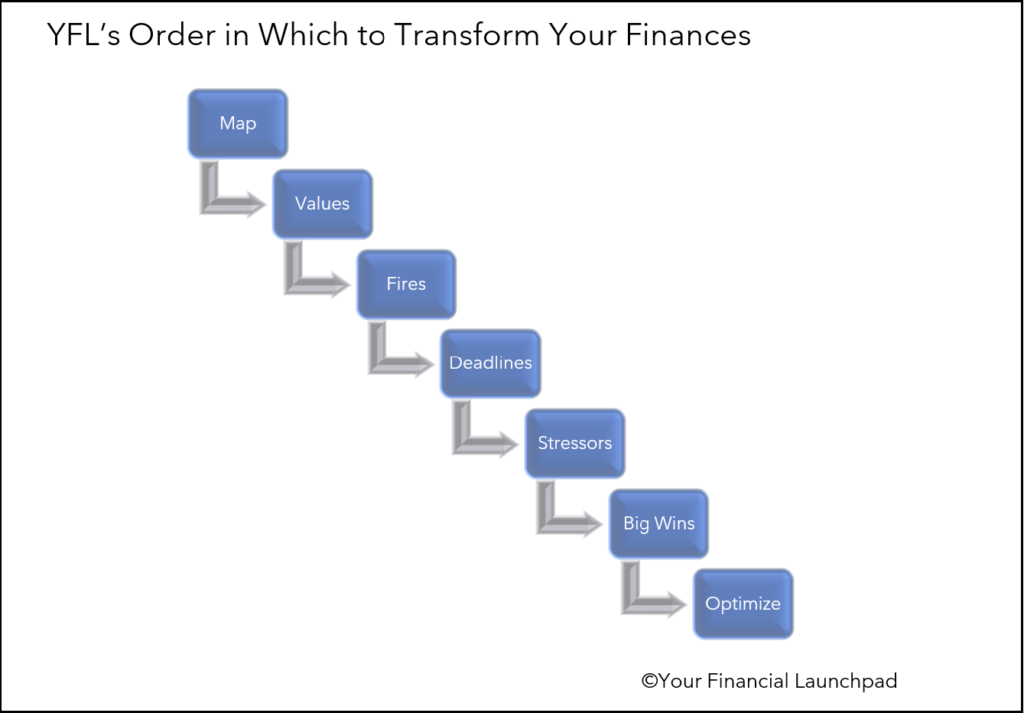

I’ve discovered, through my work with women at varying points on the path to financial freedom, that there is a hierarchy, an order, in which to tackle challenges. It’s an approach I developed over many years and have used with women in a range of financial situations with great results.

Here’s how it works.

Step 1: Draw Your Personal Money Map (MAP)

Before you make any decisions about where to start, it helps to get a sense of the big picture.

Is this step strictly necessary? No.

Is it helpful? Absolutely!

For example, if you’ve just lost your job, you might reasonably say, “I know exactly what the problem is and what I need to do first. I need a job!”

While that might be true, the picture may be more complicated than that, as I’ve seen many times with clients. A sudden loss of income can reveal other issues, like significant overspending and a related debt problem.

Yes, the lack of income is a pressing problem (acute issue that gets your attention), but the spending and debt habits will hurt you in the long run (chronic money issue that slowly harms you).

In order to get a sense of the whole, I created the Personal Money Map Technique which I explain in this blog post. In this technique, you draw a picture of your finances that clearly demonstrates the following:

- whether your finances are driven by assets (things you own that put money into your accounts) or liabilities (things that cost you money and drain your accounts)

- what the gaps are

- where you can grow your savings

- where you can save money

- what you can automate to save time and money

Creating a visual representation will help you get a sense of your priorities. Start here regardless of your situation.

It only takes about an hour to pull off; two max. And it will pay off big-time in terms of helping you gain clarity.

The more clarity you have about your situation, the more effective you’ll be in taking your finances to the next level.

Step 2: Identify Your Values and Goals (VALUES)

I put this step in here fully recognizing that it takes a while to complete. You probably won’t be able to create a list of your core values and your values-based goals before dealing with the next steps.

However, if you want your money to serve you in the highest, best possible way and you want to create a life you love, then connecting with your core values and having them drive your financial decisions is key.

Whenever I help a woman tackle her financial goals, we always start by talking about what she values. It is without a doubt the most effective way I’ve found to help women create simple financial systems they want to maintain and to make financial decisions that lead to greater fulfillment.

Otherwise, your financial choices my be inconsistent and/or rudderless.

This step alone has helped countless women significantly grow their savings as they eliminate what they call pointless expenses that add no real value to their lives. The result? More available money and more joy.

As you tackle the next steps, ask yourself, “What do I value? What matters most to me? What is the best path for me to help me accomplish my most meaningful goals?”

Use your values as your guide.

If you’re having trouble figuring out what your values are, I want you to know that you’re not alone. It sounds like a simple exercise that should be obvious to all of us, but it’s not.

Sometimes, it’s not easy figuring out what really matters most, nor is it an easy thing to put it into consistent practice in our lives. I’ve been there; I know how confusing it can be.

Which is why I’m putting together a workshop to help walk you through the process of identifying your core values and creating values-based goals. Keep an eye on my newsletter for more details later this month.

Step 3: Put Out the Fires (FIRES)

If you’ve got your head under the kitchen sink dealing with a leak and someone in the house yells, “Fire!”, you probably wouldn’t say, “Yeah, yeah, hold on. I just want to finish this first.”

My bet is that you’d move in a hurry!

The thing about fires is that they’re pressing and dangerous. They definitely pull rank when it comes to getting your attention.

The same goes when you’re trying to sort out where to start improving your finances. If you have figurative fires in your money system, they take priority over everything else.

Covid-19 caused a heap of fires for families – immediate loss of income and kids at home requiring both care and help with learning. Suddenly, the question “What do we do about income and the kids?” was top of the problems-to-solve-right-now list.

Receiving a bad diagnosis is also the equivalent of dealing with a fire as it has immediate and significant consequences for all aspects of your life.

Suddenly finding yourself separated or widowed and on your own financially is another fire.

Are you dealing with any financial fires? Situations that immediately threaten your ability to thrive?

They get your attention first and become the #1 priority for your time, energy, and creativity.

A Case Study

Shannon* was in a difficult position. She was in a marriage that wasn’t safe for her or her children. She was planning to leave her husband of many years, but that would mean having to deal with multiple big decisions on her own.

What would they do about the kids?

Where would she live?

How could she learn to manage finances overnight since her husband had taken care of this during their marriage?

How would they handle the debts?

What should she do with the money from the sale of the matrimonial house? She had a good, secure income but she had no real savings and there were debts. Should she buy another house? Invest the money? Save it for possible unexpected expenses, including dealing with significant medical costs?

Get it out of your head

When we connected, prior to her separation, Shannon was feeling overwhelmed and low. I had her do a brain dump via email. “Put it all on there,” I instructed her. “The financial good, the bad, the ugly, in as much detail as you can. Let’s get this out of your head and in writing so we can start to make sense of the moving parts and free up some brain space for self-care.”

Once she had done that, it became clear that the “fire” in her life was the fact that she needed to get out of the house and into her own, safe space. That meant selling her house.

As soon as we identified this as her first focal point, she turned whatever attention and energy she had to preparing the house for the sale. We used my mantra of “Only one thing at a time” to keep her from spiraling downward and becoming overwhelmed by what lay ahead.

There is no tomorrow; only today. Focus on the moment.

In a surprisingly short period of time, she found a Realtor, made necessary repairs to sell the house, and secured a buyer. The money from the sale of the house helped her to pay off her debts entirely and provide a good cushion as she moved on.

Now that the fire was out, it was time to turn our attention to the next steps. I’ll continue her story below.

Step 4: Deal With Deadlines (DEADLINES)

If there are no fires in your system, the next question to ask revolves around deadlines. Are you facing any time-sensitive decisions for important parts of your system?

We’re talking about things like:

- mortgage renewals

- insurance policy renewals

- investments maturing, requiring decisions

- investment deadlines, like RRSP deadlines in Canada

- tax submission deadlines

- job application deadlines

These all play an important role in your finances. If you have deadlines coming up, those take priority after dealing with financial fires.

Step 5: Address Major Stressors (STRESSORS)

What keeps you up at night?

What are you worried about?

At the moment, what is your biggest source of stress?

There is usually one or two things that stand out for most women when they look at their Money Map and consider their current situation.

Sometimes, the things that stress us out aren’t the most important from a financial point of view, but because of their emotional impact, they take up a lot of cognitive bandwidth. It’s important to identify these items and resolve them as quickly as possible.

When you do that, it’s like taking a deep breath for your brain.

Without an ongoing source of irritation, it’s easier to get creative and to focus on the actions that will get us big results.

Back to Shannon

Once Shannon got herself safely into a new place of her own, I asked her the questions listed at the top of this step:

“What is your biggest source of stress at the moment?”

Without skipping a beat, she replied that her biggest source of stress was the fact that her insurance company had stopped covering significant medical costs for an ongoing condition. Fixing the situation would require a lot of effort and time. Since it didn’t seem to be the biggest financial priority, she had let it go for the time being.

“What would it mean to you to get this item sorted out and off your list?” I asked her.

“It would offload a ton of stress and ensure that I don’t face ongoing expenses at a time when there is already a great deal of financial uncertainty in my life,” she replied.

That was her answer. At a time when she was carrying a super-sized load of stress, this item became the most pressing one of all to attend to.

It was more important than figuring out how to manage her money. And it was certainly more important than figuring out what to do with the money remaining from the sale of her home.

Both of those could wait; we would get to them in good time. Her life wouldn’t fall apart if she didn’t have a smooth financial system in place in the next month or two. Just keep paying the bills on time and focus all your energy on resolving the insurance issue, I suggested.

Shannon dealt with the insurance company, who agreed to resume covering medical expenses, and in the process she eliminated another major stressor.

She was now ready to tackle her day-to-day finances and set up a simple system to help her thrive.

Step 6: Go For the Big Wins (BIG WINS)

In my experience, most people who are looking to make financial gains focus their time and energy in the wrong place. They focus on small, easy, obvious wins.

Cut out a few trips to Starbucks. Net savings = $30/month.

Use cost-cutting apps and look for sales. Net savings = $50/month.

Coupons, cutting out occasional Starbucks coffees, and other sorts of measures feel productive because they net you a few easy dollars in little time, with minimal effort.

The problem is that those dollar-here-dollar-there savings don’t really move your financial needle.

The reality is that the majority of your money is spent in a handful of categories: housing, food, transportation, debt servicing, and for some, medical costs. You could also argue that communication makes up a good chunk of spending in some households.

The upshot is that the concentration of your spending in these categories uses up the lion’s share of your money. If you want to make significant gains financially, start by digging into these major categories and asking if the amounts you spend there are serving you well.

Questions to ask

How much of your total income are you spending on housing? That includes the mortgage or rent, taxes, insurance, utilities, repairs, maintenance, improvements, discretionary items like those cute pillows you found at Home Sense and the endless array of items you grabbed at Costco.

Most of the multi-millionaires I know spend well below what they can afford for housing. Tellingly, they never ask mortgage agents, “How much can I afford to buy?” because they think differently about spending money. They don’t seek to spend the maximum they can afford because they understand that until they sell their primary residences, they act as liabilities which drain their accounts. They want to spend the right amount for them on housing based on their goals.

By contrast, when I ran a Rent to Own company where we worked with clients to help them buy houses, most would ask me, “What’s the maximum house purchase I can afford?” These clients had been rejected by lenders because of their debt levels, poor credit, a lack of down payment, or some combination of those.

Isn’t that interesting?

Back to questions: What about the amount you pay for your cars and other transportation costs?

Cable?

Credit card fees?

Last year, I issued a challenge to my community: Review your major spending categories, ask critical questions (which I provided), and see how much you can save by addressing these key areas.

One woman wrote back to me to say that this one exercise ended up saving her $845 per month!! You can read about that story here. She now has more than $10,000 every year to build wealth and create better options for herself.

How cool is that?!

You can search for coupons and cost-saving apps all you like, but they will never yield that kind of return.

Go for the big wins.

Step 7: Optimize Your Finances (OPTIMIZE)

Once you’ve taken care of all the above, pop back to your Personal Money Map and identify the following:

- the areas that need to be modified or simplified to be more effective. Where could you improve your system? Are you tracking the right things?

- what you can automate – savings, bill payments, electronic reminders to stay on track, accountability.

- the areas you need to review on a regular basis. These get electronic reminders and fixed dates in your calendar.

- what you need to learn. This is crucial. Your finances will only ever rise to the level of your knowledge, confidence, and execution of key actions.

- all the low-hanging fruit – expenses you can easily eliminate, putting that money to better use.

Which expenditures that don’t serve you well. Do you really need another cute shirt or decoration for your back yard from Costco?

All the spending that doesn’t fit your values. The gym membership you don’t use – you hate the gym, but feel you should go. The subscriptions you feel you should read, but never get to. If they’re not serving you well, get rid of them and put the money to work on what you value.

One last thing: If you’re having trouble sticking with a financial system, then chances are that your system isn’t serving you well or you’re up against a mindset block. It’s worth asking, “I wonder why this is an issue for me?”

A Recap

With this approach, you will move the needle in your finances, just like Shannon did.

Shannon has completely transformed her finances and she’s now on track to do the same with her life.

You can use the same process to take a good/mediocre/challenging financial situation to the next level. Just follow the steps and stay true to your values.

I wish you much success. You’ve got this!

If you use this approach, shoot me a comment below and let me know how you make out. I’d love to hear from you.

Want to receive my weekly money tips and strategies?

Don’t miss a thing! No spam, ever.